Linear depreciation calculator

It provides a couple different methods of depreciation. For example if an asset is worth 10000 and it depreciates to.

Straight Line Depreciation Formula Guide To Calculate Depreciation

Free linear equation calculator - solve linear equations step-by-step.

. First one can choose the straight line method of. Lets take an asset which is worth 10000 and. The basic formula for calculating your annual depreciation costs using the straight-line method is.

Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of SalvageCost 1Life Variable Declining Balance Depreciation. The calculator allows you to use. It is important to note that there are other methods.

If the depreciation pattern is accelerated evaluate whether a fixed depreciation rate can be used resulting in use of an exponential curve as described in Section 61. The depreciation rate stays the same throughout the life of the asset used in this calculator. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

When the value of an asset drops at a set rate over time it is known as straight line depreciation. After a few years the vehicle is not what it used to be in the. If the depreciation pattern.

Straight Line Depreciation Calculator. In the simplest terms depreciation is the decrease in valueImagine that you bought a car for 20000. Lets take a piece of.

Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of. There are four main methods to account for depreciation. This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods.

Therefore you can calculate depreciation for a computer by using the linear method. Build Your Future With a Firm that has 85 Years of Investment Experience. Build Your Future With a Firm that has 85 Years of Investment Experience.

To calculate straight-line depreciation. In the non-linear method the accrued amount per month for the depreciation asset is. All you need to do is.

Select the currency from the drop-down list optional Enter the. Straight Line Depreciation Calculator. Section 179 deduction dollar limits.

Straight Line Asset Depreciation Calculator. Straight line depreciation is where an asset loses value equally over a period of time. Linear depreciation is the most common way to calculate the depreciation of tangible fixed assetsespecially in SMEs.

This limit is reduced by the amount by which the cost of. It is fairly simple to use. Find the assets book value by subtracting its.

Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Asset Cost Salvage Value Useful Life Depreciation Per Year.

The calculator also estimates the first year and the total vehicle depreciation. The amount of value an asset will lose in a particular period of time. This depreciation calculator is for calculating the depreciation schedule of an asset.

What Is The Straight Line Depreciation Formula How To Calculate Straight Line Depreciation Video Lesson Transcript Study Com

Straight Line Depreciation Youtube

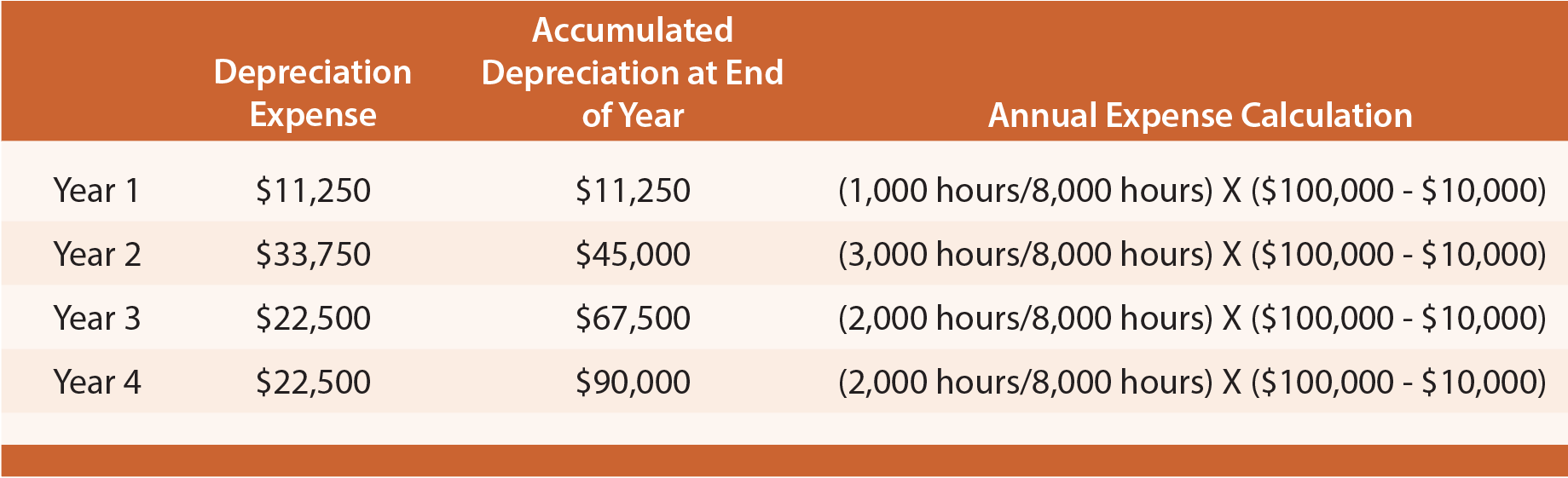

Depreciation Methods Principlesofaccounting Com

Depreciation Formula Calculate Depreciation Expense

Straight Line Method For Calculating Depreciation Qs Study

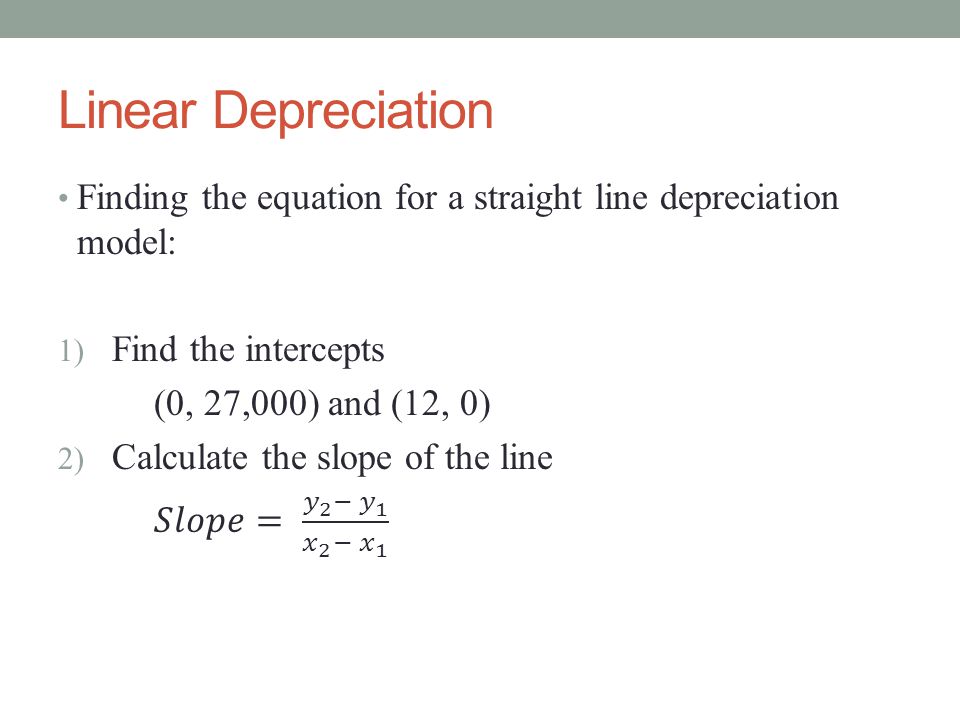

Linear Automobile Depreciation Ppt Video Online Download

Straight Line Depreciation Double Entry Bookkeeping

Straight Line Depreciation Template Download Free Excel Template

Method To Get Straight Line Depreciation Formula Bench Accounting

Macrs Depreciation Calculator With Formula Nerd Counter

Linear Depreciation Hw 1 Problem 31 Youtube

Straight Line Depreciation Formula And Calculation Excel Template

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping

Double Declining Balance Depreciation Daily Business

Excel Straight Line Depreciation Calculator Spreadsheet Free Download

Straight Line Depreciation Calculator Double Entry Bookkeeping

Straight Line Depreciation Formula And Calculation Excel Template